Wealth Creation

The term 'Wealth Creation' connotes generating money in abundance or disproportionately.

An obvious question comes to one’s mind: How do I generate disproportionate money in years to come?

You have a fixed set of commercial activity: your job or business which earns handful of money and against which you have household expenses, EMI and luxury expenses, leaving a paltry sum as savings. If you only depend on these savings by keeping cash or parking it in savings account for wealth creation, it may take decades to reach the goal. You definitely need an extra booster to reach the goal early.

You have to consciously understand that you are not alone in this wealth creation journey; there is one more fictitious person working for you whom I call as 'Motabhai'.

Wondering?

Let’s understand in more detail:

Suppose you have a job or business which generates 100,000 a month, out of which you pay 40,000 as household expenses, 25,000 as EMI and 15,000 you keep for your luxury spends. This leaves 20,000 towards savings. This will have to be invested in superior return generating assets like equities or real estate.

What you have to do?

You have 3 monsters in your cash flow - expenses, EMI and extra spends. Your aimshould be to maximise savings element by protecting your income from these 3 monsters. Of-course, you cannot completely rule it out but you can at-least reduce them.

How to do that?

Prepare a cash-bank statement every month which will reveal astonishing facts about your spending habits. It will surely help you to identify and cut down unnecessary spends - you may cut spends on restaurant, movies, satisfy yourself with a lower brand clothing, etc. This will help in increasing savings.

What will Motabhai do?

You might have studied the concept of Compound Interest in school mathematics (ChakravartiVyaaj as commonly known in India). You may find it hard to recollect it as it involved a troublesome calculation! This concept is of immense importance and understanding it deeply at this age of our life will surely push our wealth by many miles. Wealthy people regard Compound Interest as eighth wonder of the world and so great it is!!

Compound Interest is a function of rate of interest and time. The higher the rate of interest the larger the compounding. Similarly, the longer the time duration the larger the effect of compounding.

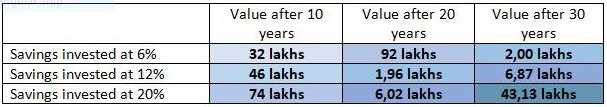

Taking some figures from our previous example, your saving of 20,000 per month will translate into 2.40 lakhs per year. If you continue to save at this rate for 30 years then your savings amount will be 72 lakhs. Now, we will tabulate these figures to understand the compounding effects:

Clearly, given higher rate of interest and longer duration, compounding effect will take your wealth to bliss!!

One more interesting observation:

There is difference between your and Motabhai's effectiveness at work. When you become older, you reach a maturity phase - your rate of increment at job / business reduces and your expenses increases with larger family which takes a toll on the amount you can save. However, Motabhai's effectiveness increases as it grows older and older. It generates more wealth due to compounding effect and eventually turns out to be a wealthy member in your family.

So, in a nutshell you should focus on:

1. Controlling your routine expenses, EMIs and luxury spends

2. Be disciplined in your savings

3. Start investing at early age

4. Choose the right investment instrument