Bonds

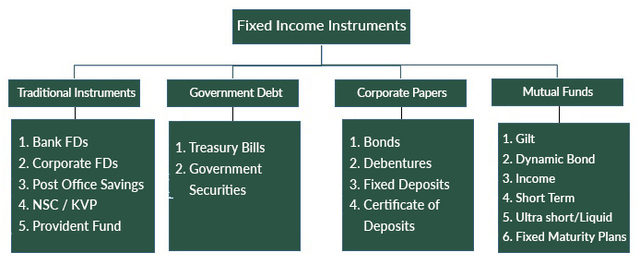

We have been accustomed to understand bonds / fixed income securities as an investment which gives us fixed rate of return till its maturity. Simplest example is bank fixed deposit or a national savings certificate wherein amount is invested for a fixed duration with a fixed rate of interest and we get amount on maturity. Similarly, there are instruments like corporate bonds and government securities. While it is true that this instrument gives fixed rate of interest for fixed duration, but there is much more to it. Assume a situation where you invest in a bond which is allowed to be traded on a regular basis like shares; imagine what could be the trading price? will it be the face value or any other rate determined by market forces

Let’s understand this in detail:

Glossary

- Debt Instrument: refers to any type of investment wherein a person lends money to the borrower in return for a fixed payment called interest.

- Coupon Rate: is the amount of interest paid per year expressed as a percentage of the face value of the instrument.

- Yield to Maturity: measures the annual return an investor would receive if he held a particular instrument till maturity. YTM is the composite rate of return of all the coupons and capital gain (or loss).

- Market Price: Face Value + Accrued Interest +/- Premium/Discount

- Dirty Price: Market Price – Accrued Interest

- Yield is inversely proportional to Market Price.

|

Yield Curve

|

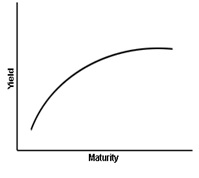

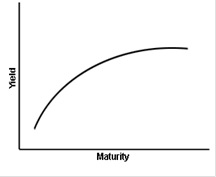

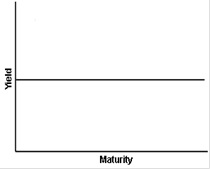

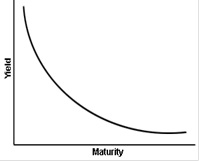

Types of Yield Curve

|

Normal Yield Curve:

|

Flat Yield Curve:

|

Inverted Yield Curve:

|

Are Debt Instruments Risky?

Yes, there is certain degree of risk involved in these instruments depending on the issuer and other macro-economic variables. They are

- Credit Risk

- The Issuer is not able to pay back maturity and / or coupon amount.

- To subside this risk, choose instrument with higher rating; higher the rating of an instrument less is the chance of your investment facing a default risk.

- Interest Rate Risk

- There is an inverse relationship between interest rates and bond prices. If the interest rates goes up, the bond prices depreciate and vice versa.

- Debt instruments such as fixed deposits don’t suffer from interest rate risk.

- Inflation Risk

- High inflation has potential to reduce your real return.

- Longer the tenor of the bond, higher is the chance that inflation will affect real return.

- Call Risk

- The issuer, many a times, gives an option to buy-back the bonds before expiry of the tenor.

- This option is made available by the issuer when interest rates are expected to fall and the present bonds becomes expensive to the Issuer.

How to Analyse?

Following factors needs to be considered:

- Assess interest rate scenario:

- Rising interest rates – prefer instruments with shorter maturity

- Falling interest rates – prefer higher duration instruments

- Compare rating of the instrument:

- Prefer AAA or AA+ instruments: it will offer lower yield but degree of safety will be high

- What’s term of your investment:

- Long term – prefer long term bonds, PPF

- Short term – prefer debt mutual funds, FMPs

- Is liquidity necessary:

- If liquidity is preferred, choose listed bonds, NCDs or debt mutual funds